st louis county personal property tax on car

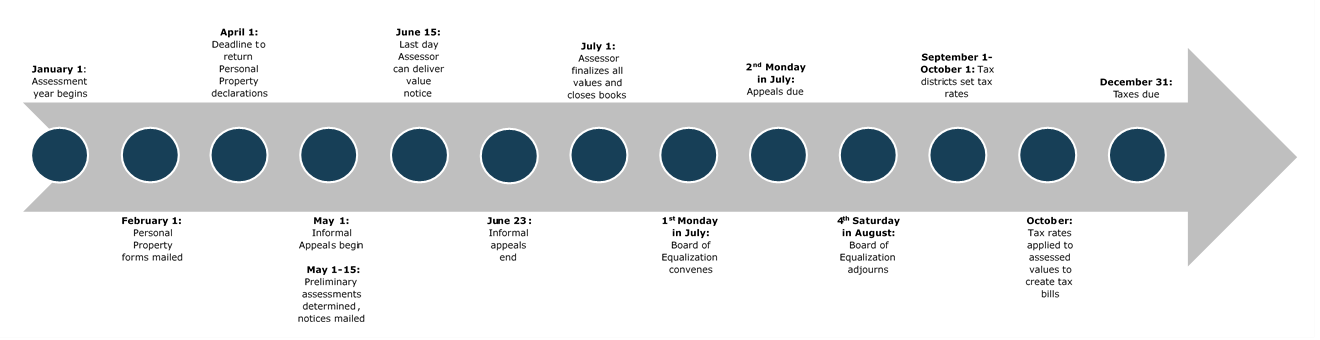

Assessor - Personal Property Assessment and RecordsAssessor - Real Estate Assessment and AppraisalAssessor - Real Estate Records Summary Provides formulas used to calculate personal property residential real property and commercial real property. Business personal property issues can only be addressed at our Clayton location.

Missouri state law says so.

. Louis 63129 the South County Government Center is available for rent. Please come to the Roos County Government Building 41 S Central Ave in Clayton 63105 for questions. The assessment is made as of January 1 for the current years tax and is predicated on 33 13 of true value.

Account Number or Address. If you did not file a Personal Property Declaration with your local assessor. Your county or the city of St.

Charles County to ease the burden of inflation on personal property tax rates. Louis County Missouri - St. Charles County Collector of.

You must present the receipts an original photocopy fax copy or copy of an internet confirmation screen is acceptable when you obtain license plates. The Crossings at Northwest is located at 500 NW Plaza Dr St. USPS mail or Drop-Off in the Clayton Lobby.

Central Ave Clayton MO 63105 and include the. Unsure Of The Value Of Your Property. Louis County is 141 percent which is the highest rate of any county in the state.

The short answer to why Missourians have to pay property taxes on cars motorcycles trucks and boats is relatively straightforward. You may pay at our office located at 729 Maple Street Hillsboro MO 63050 online at Jefferson County Property Taxes or by Interactive Voice Response by calling 877-690-3729 if paying by IVR you will need to know your bill number. Paid Personal Property Tax Receipts.

Individual Personal Property Declarations are mailed in January. Ad Find County Online Property Taxes Info From 2021. What is the personal property tax on a car in Missouri.

8am 430pm M F. Leave this field blank. Or an Application for Missouri Title in your name or out-of- state registration of your car.

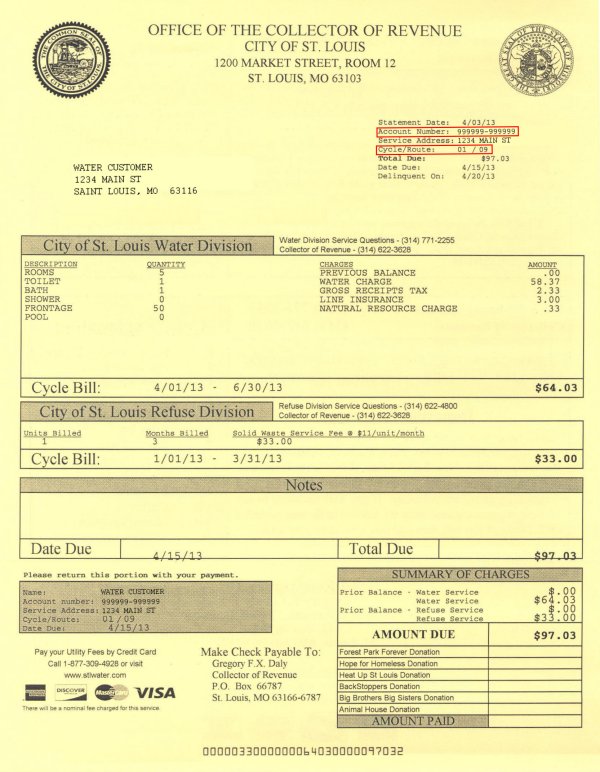

You may click on this collectors link to access their contact information. Property Tax Receipts are obtained from the county Collector or City Collector if you live in St. Personal property tax waivers Personal property accountstax bill adjustment add or remove vehicle Pay taxes EXCEPT for delinquent real estate taxes 2017 and older.

The majority goes to schools fire and libraries. Find All The Record Information You Need Here. Louis City in which the property is located and taxes paid.

On average the property tax on real estate in St. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. IF TIME IS NOT AN ISSUE you can.

Collector of Revenue 41 S. PUBLISHED 457 PM ET Jul. You pay tax on the sale price of the unit less any trade-in or rebate.

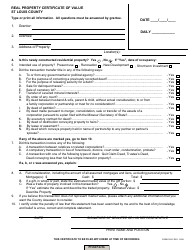

8am 430pm Services Offered. To declare your personal property declare online by April 1st or download the printable forms. Ad The Leading Online Publisher of National and State-specific Leases Legal Documents.

Used car values have increased over 20 since 2021 because of their demand during a vehicle shortage meaning residents will have to pay more on their personal property taxes. Missouris effective vehicle tax rate according to the study is 272 percent which means the owner of a new Toyota Camry LE four-door sedan 2018s highest-selling car valued at 24350 as of February 2019 would pay 864 annually in taxation on the vehicle. Located at 4546 Lemay Ferry Road St.

Account Number number 700280. Subtract these values if any from the sale. This would only impact the countys portion of funds from personal property tax.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. You can also obtain a receipt for 100 at one of our offices. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

If you have questions about whether your vehicle was taxed or the value please contact the Leasing Section at 314-615-5102. Paid Personal Property Tax Receipts. Louis MO 63129 Check cash money order Check cash money order M F.

However the city. For a pamphlet with information on Small Claims Court call 314-615-2601 or 314-615-2592. It is also well above the national average.

The leasing company will be billed for personal property tax directly. What is the personal property tax on a car in Missouri. There is a push in St.

All City of St. Declare Your Personal Property Declare your personal property online by mail or in person by April 1st and avoid a 10 assessment penalty. Louis collectors office sent you receipts when you paid your personal property taxes.

Missouris effective vehicle tax rate according to the study is 272 percent which means the owner of a new Toyota Camry LE four-door sedan 2018s highest-selling car valued at 24350 as of February 2019 would pay 864 annually in taxation on the vehicle. Obtaining a property tax receipt. Louis taxpayers with tangible property are mandated by State law to file a list of all taxable tangible personal property by April 1st of each year with the Assessors Office.

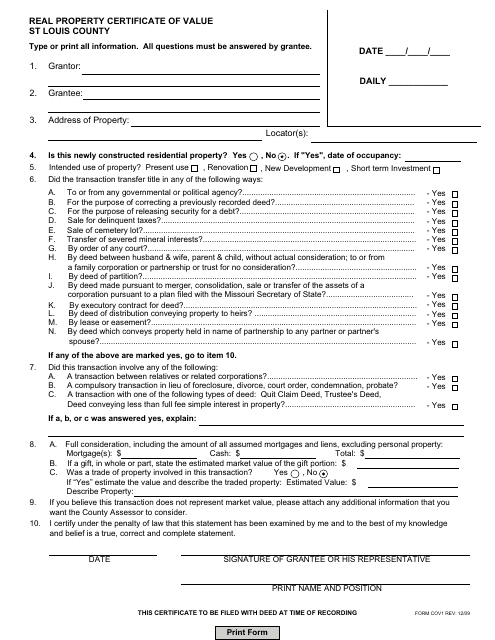

Personal Property Declaration St Louis County Fill And Sign Printable Template Online Us Legal Forms

Reasons Why Hiring A Title Company Is Important

St Louis County By Stltoday Com Issuu

Department Of Revenue St Louis County Missouri Forms Pdf Templates Download Fill And Print For Free Templateroller

Property Details Search Property Details Search

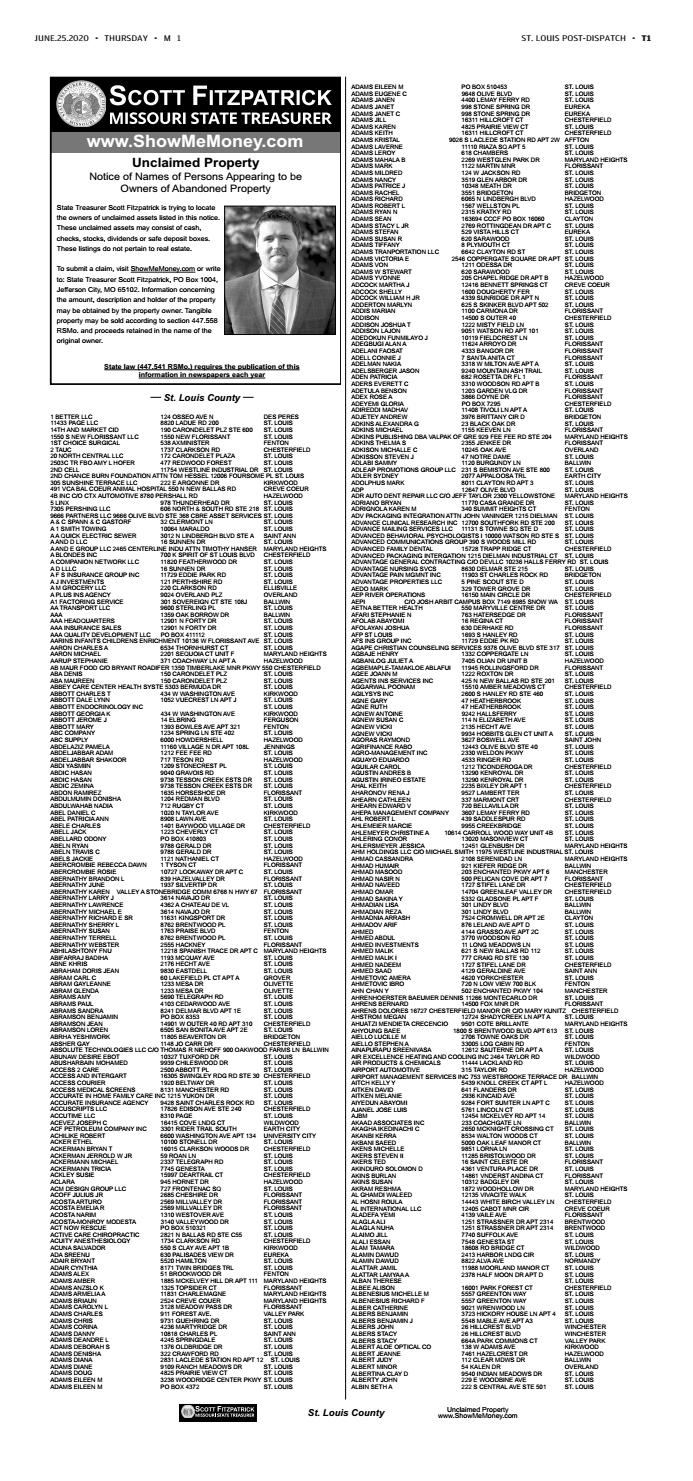

2014 St Louis County Unclaimed Property By Stltoday Com Issuu

Hire St Louis Buyer Expert Realtors Now Before Homes Are Gone Winter Garden Florida Renting A House House Prices

Print Tax Receipts St Louis County Website

Print Tax Receipts St Louis County Website

2020 Unclaimed Property St Louis County By Stltoday Com Issuu

What Does An Eviction Notice Look Like Free Printable Documents

Collector Of Revenue St Louis County Website

Department Of Revenue St Louis County Missouri Forms Pdf Templates Download Fill And Print For Free Templateroller

Action Plan For Walking And Biking St Louis County Website